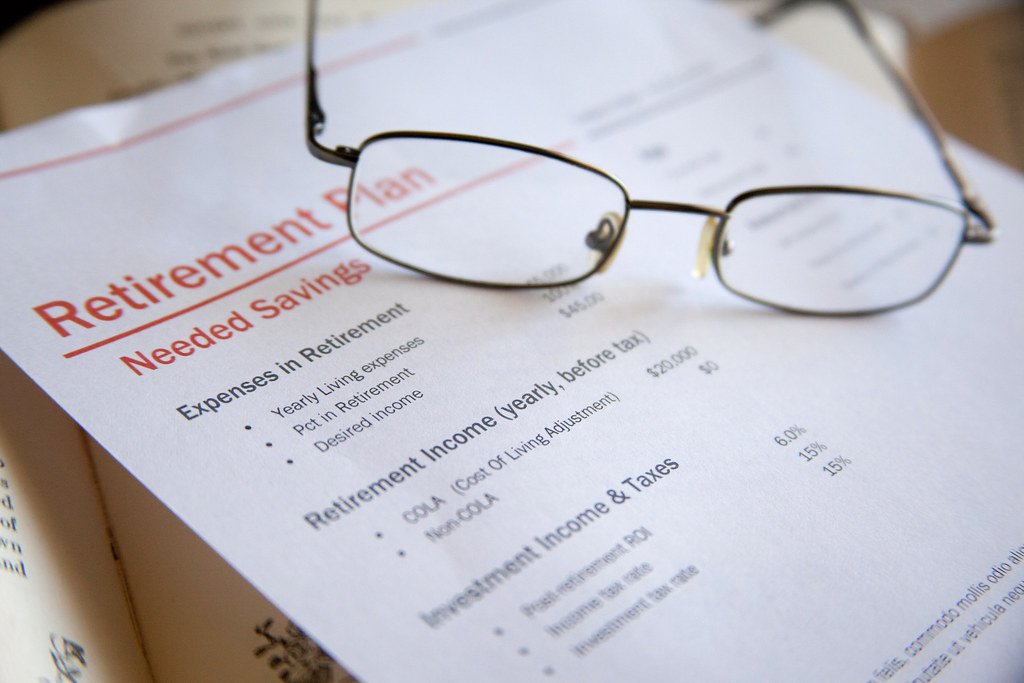

As we enter retirement, one of the biggest concerns is how to maximize our income while maintaining a comfortable lifestyle. With various options available, it can be overwhelming to choose the right one that suits our specific needs. However, what if there was a way to unlock the value of your property and use it to supplement your retirement income? In this blog post, we’ll explore how Furness Building Society Equity Release could be the solution you’ve been looking for. So sit back and discover how you can potentially boost your retirement income without having to sell your beloved home.

Introduction: Understanding Furness Building Society Equity Release

If you’re looking for a way to maximize your retirement income, Furness Building Society Equity Release may be the solution you need. This financial product allows you to release equity from your home without having to sell it or move out. Essentially, you’re borrowing against the value of your property and receiving a lump sum or regular payments in return.

Furness Building Society is a trusted provider of equity release plans, with a focus on helping retirees achieve financial security and peace of mind. By unlocking the value of your home, you can supplement your pension income, pay off debts, make home improvements, or fund other expenses in retirement.

Before deciding if equity release is right for you, it’s important to understand how it works and what the eligibility requirements are. In the following sections, we’ll explore these topics in more detail and provide expert tips on maximizing your retirement income through financial planning tools.

How Furness Building Society Equity Release Works for Retirement Planning

Equity release is a financial product that allows homeowners aged 55 or over to access the equity in their property, tax-free. With Furness Building Society Equity Release, you can have a lump sum payment or regular income stream to supplement your retirement income. The amount of equity that you can release depends on several factors such as the value of your home and your age. One key feature of Furness Building Society Equity Release is that they offer competitive interest rates and flexible repayment options. When taking out an equity release plan with Furness, you retain ownership of your home and can continue to live there until death or long-term care needs arise. Another important aspect is that your estate will not be left with negative equity when repaying the loan from the sale proceeds at death or when moving into long-term care.

Benefits of Using Furness Building Society Equity Release for Retirement Income

Furness Building Society Equity Release offers a range of benefits for those looking to maximize their retirement income. One of the key advantages is the ability to access tax-free cash from the equity in your home without having to sell it. This can provide a significant boost to your retirement income and help you maintain your standard of living.

Another benefit is that you can choose how you receive the funds, whether as a lump sum or in regular payments. This flexibility allows you to tailor the plan to your specific needs and goals.

Additionally, with a Furness Building Society Equity Release plan, you can continue to live in your home for as long as you wish. You also have the option to move house in the future and transfer the plan to your new property.

Overall, Furness Building Society Equity Release provides a reliable and secure way to supplement your retirement income while retaining ownership of your home.

Eligibility Requirements and Qualifying Factors

Age and Property Ownership Requirements for Equity Release

To qualify for Furness Building Society Equity Release, you must be a homeowner aged 55 or over. The value of your property must also meet the minimum threshold set by the provider. This is typically around £70,000 but may vary depending on individual circumstances. It’s important to note that the amount you can release will depend on your age and the value of your property. The older you are and the more valuable your property, the more equity you can release. Additionally, the property must be your primary residence and should not have any outstanding mortgage or secured loans.

Understanding the Loan-to-Value Ratio: How Much You Can Borrow

The loan-to-value (LTV) ratio is a crucial factor in determining how much you can borrow through Furness Building Society Equity Release. This ratio represents the percentage of your home’s value that you are eligible to borrow against. Typically, the higher the LTV, the less equity you will have left in your property after borrowing.

Furness has set its maximum LTV at 55%, meaning that if your home is valued at £300,000, for example, you may be able to release up to £165,000 tax-free cash with an equity release plan from Furness Building Society. However, other factors such as age and health also come into play when determining eligibility and qualifying factors. It’s always best to speak with an expert advisor who can guide you through all aspects of eligibility requirements and help determine which plan might work for you.

Factors that Affect Your Eligibility for Furness Building Society Equity Release

To be eligible for a Furness Building Society equity release plan, you must be at least 55 years old and own your home. The amount released depends on several factors such as the value of your property, age, and health status. Credit history also plays an important role in determining eligibility. If you have existing mortgages or debts secured against your property, these will need to be repaid using the equity release funds. Other key considerations include the type of plan chosen and any associated fees involved in setting up the plan. It’s important to seek independent financial advice before deciding whether a Furness Building Society equity release plan is right for you.

Common Misconceptions About Equity Release: Separating Myths from Facts

One of the most common misconceptions about equity release is that it’s only available to homeowners who have paid off their mortgage. However, this couldn’t be further from the truth. Another myth surrounding equity release is that your heirs will be left with debt after you pass away, but in reality, all reputable providers like Furness Building Society offer a no-negative-equity guarantee.

It’s important to separate fact from fiction when considering an equity release plan. Trusted providers such as Furness carefully consider eligibility requirements and qualifying factors before offering a plan to ensure it is suitable for each individual circumstance.

Different Types of Plans Offered by Furness Building Society Equity Release

Furness Building Society Equity Release offers two types of plans: Lifetime Mortgage and Home Reversion. With the Lifetime Mortgage plan, borrowers can take out a loan secured against their property’s value that they only repay once they pass away or move into long-term care. The interest on this loan is compounded over time and added to the original amount borrowed, so it may accumulate quickly. Conversely, the Home Reversion plan involves selling part or all of your property to Furness in return for a cash lump sum or regular income payments while retaining the right to live there rent-free for life. This option allows you to know upfront how much equity you are releasing but might not be suitable if you want to leave an inheritance. It’s essential to consult with experienced financial advisors who can help you choose which plan aligns best with your objectives before making any commitments.

Common Misconceptions and Myths About Equity Release

Debunking the Top 3 Myths About Equity Release

Equity release has long been plagued by several myths and misconceptions, causing many seniors to be sceptical about it. Here are the top 3 most common myths about equity release debunked.

Myth: You will lose ownership of your home

Fact: Furness Building Society Equity Release allows you to keep ownership of your property while accessing its value as a source of retirement income.

Myth: Your heirs will be left with nothing

Fact: With most equity release plans, including those offered by Furness Building Society, inheritance protection is included in the contract.

Myth: Equity release is only for people with poor financial planning

Fact:Furness Building Society Equity Release can benefit anyone who owns a home and is over 55 years old looking for extra funds towards a comfortable retirement lifestyle. It’s important to seek professional advice before making any decisions about equity release plans to maximize their benefits while minimizing risks.

Understanding the Risks and Rewards of Equity Release

When considering equity release, many retirees are skeptical due to the misconceptions surrounding it. However, it is important to understand the risks and rewards of this financial planning tool before making a decision. While equity release can provide additional retirement income, it may also impact inheritance and eligibility for means-tested benefits. It is crucial to consider all factors with a trusted provider like Furness Building Society Equity Release and seek legal advice before committing to a plan. By understanding the potential risks and rewards, retirees can make informed decisions about whether equity release aligns with their financial goals.

Why Equity Release is Not a Last Resort Option for Retirement Income

Equity release is often thought of as a last resort for those who have exhausted all other options. However, the truth is that it can be a viable and beneficial option for retirees looking to supplement their income. One key benefit of this type of plan offered by Furness Building Society Equity Release is that it allows you to access the wealth tied up in your home without having to sell or downsize. Another important point to understand is that with responsible financial planning, equity release can actually provide greater financial security and peace of mind during retirement. So don’t dismiss equity release as a last resort – consider it as a valuable tool in your retirement income strategy.

The Truth About Inheritance and Equity Release: Separating Fact from Fiction

Many people believe that equity release will leave nothing for their heirs. This is a common misconception as Furness Building Society Equity Release plans offer several options including inheritance protection, allowing homeowners to safeguard a portion of their home’s value for their beneficiaries. In fact, many plans enable individuals to ring-fence a percentage of the property’s future value, despite releasing funds now. It’s important to note that equity release can reduce the overall value of your estate and may impact means-tested benefits. However, with careful consideration and professional guidance from trusted providers like Furness, you can make informed decisions about your financial future while still leaving an inheritance for your loved ones.

Key Considerations Before Opting for a Furness Building Society Equity Release Plan

Before considering an equity release plan with Furness Building Society, it’s important to understand that this type of financial product should only be considered as a last resort. It’s also worth noting that taking out an equity release could affect your entitlement to state benefits and grants.

Additionally, there are fees associated with obtaining an equity release product, such as setup costs, solicitor fees and valuation fees. These can add up quickly and eat into the money you receive from releasing equity in your property.

It’s essential to note that using plain language without industry jargon is crucial when communicating with advisors or providers about any plans or schemes related to the Furness Building Society Equity Release option.

Finally, it’s advisable to speak with a professional financial advisor before making any decisions regarding equity release products. They will assess your unique situation and help you determine whether this type of product is suitable for achieving your retirement goals while still protecting your long-term interests in mind.

Expert Tips on Maximizing Your Retirement Income through Financial Planning Tools

When it comes to maximizing your retirement income, financial planning tools can be incredibly helpful. One such tool is a budget planner, which can help you identify areas where you can cut back on expenses and save more money. Another useful tool is a retirement calculator, which can help you estimate how much income you’ll need in retirement and how much you’ll need to save to achieve that goal.

It’s also important to consider diversifying your investments. While equity release can be a valuable option for unlocking the equity in your home, it shouldn’t be your only source of retirement income. Consider investing in stocks, bonds, and other assets to help spread out your risk and potentially increase your returns.

Finally, don’t forget to review your retirement plan regularly and make adjustments as needed. Your financial needs and goals may change over time, so it’s important to stay flexible and adaptable in your approach to retirement planning. By working with a trusted provider like Furness Building Society Equity Release and utilizing these financial planning tools, you can maximize your retirement income and enjoy a comfortable lifestyle in your golden years.

Why Choosing a Trusted Provider Like Furness is Crucial When Considering an Equity Plan

When considering an equity release plan, it is crucial to choose a trusted provider like Furness Building Society. With their years of experience and commitment to ethical lending practices, you can be confident that you are making a sound financial decision.

One important consideration when choosing an equity release plan is the impact it may have on your inheritance. It is important to discuss this with your family and seek professional advice before making any decisions. Additionally, it is important to consider the long-term implications of releasing equity from your home, including potential changes in interest rates and property values.

To maximize your retirement income, it is also important to utilize financial planning tools such as budgeting and investment strategies. Seeking advice from a financial advisor can help you make informed decisions about how to best use your released equity.

Overall, by choosing Furness Building Society Equity Release and taking careful consideration of all factors involved, you can confidently maximize your retirement income and enjoy the benefits of a comfortable retirement.

In conclusion, Furness Building Society Equity Release can be an excellent option for those looking to maximize their retirement income. With a range of plans and eligibility requirements that cater to different needs, it’s important to carefully consider your options and seek expert advice before making any decisions. By partnering with a trusted provider like Furness, you can rest assured that you’re making a sound financial decision that will help you enjoy your golden years to the fullest. So why wait? Start exploring your options today and take control of your retirement income with Furness Building Society Equity Release.

Are you considering loans for 10 years with a poor credit score?

The key features of a 50000 personal loan is early repayment charges, the effect of CCJs, the 3rd party valuation of the property pledged as collateral and the evidence of gambling on bank statements.

Are you considering a Starling 20 000 personal loan with a lower interest rate?

The key issues with Lloyds loans for 20000 is bad credit intolerance, the impact of defaults, the disappointing home valuation and the borrower not on the electoral register.

Are you able to borrow for bad credit loans with security with lower interest repayments?

The key features of soft search loans for bad credit direct lenders is early repayment fees, the impact of credit defaults, the delays in the property valuation and the insufficient personal income.

Are you considering an application for Santander homeowner loans without an early repayment penalty?

The key characteristics of Santander homeowner loans is the long loan term, the impact of CCJs, the 3rd party valuation of the home pledged as collateral and the evidence of too many credit applications.

Are you able to get homeowner loans for poor credit with a low fixed interest rate?

The key features of loans for homeowners with poor credit is intolerant eligibility criteria, the effect of loan arrears, the 3rd party valuation of the property pledged as collateral and the evidence of gambling on bank statements.

Are you looking for a Tesco homeowner loan for debt consolidation?

The main characteristics of Tesco home improvement loans is the variable base rate, the effect of CCJs, the delays in the home valuation and the evidence of too many credit applications.

Are you considering an application for a Barclays loan offer even with adverse credit?

The key characteristics of Barclays secured loans is short loan term, the effect of default notices, the home valuers forced sale price and the evidence of too many credit applications.

Are you able to borrow to get NatWest secured loans at an interest rate close to the base rate?

The key features of a NatWest homeowner loan is bad credit intolerance, the effect of CCJs, the discounted property valuation and the borrower not on the electoral register.

Are you able to borrow to get a Nationwide personal loan to pay for debt consolidation?

The main issues with Nationwide home improvement loans is the score from the credit report, the effect of default notices, the discounted property valuation and the evidence of too many credit applications.

Are you searching for a professional and career development loan NatWest without an early repayment fee?

The main issues with a professional and career development loan NatWest are inflexible eligibility criteria, the impact of secured loan arrears, the delays in the lenders valuation and the evidence of payday loans on bank statements.

Are you able to borrow to get a Barclays secured loan to pay for a new car?

The key features of a Barclays secured loan is bad credit intolerance, the impact of CCJs, the 3rd party valuation of the property pledged as collateral and the insufficient personal income.

Are you able to get a NatWest homeowner loan with a longer repayment period?

The key issues with a NatWest debt consolidation loan is bad credit intolerance, the impact of credit card payment arrears, the delays in the property valuation and the borrower not on the electoral register.

Questions and Answers

Who is eligible for Furness Building Society equity release?

Homeowners aged 55 and over with a property worth at least £70,000.

What is Furness Building Society equity release?

A way to release cash from your home without having to sell it.

How does Furness Building Society equity release work?

You borrow money against the value of your home, which is repaid when you die or move out.

What are the fees for Furness Building Society equity release?

Valuation fee, application fee, legal fees, and an arrangement fee.

How much can I borrow with Furness Building Society equity release?

The amount you can borrow depends on factors such as your age and the value of your property.

What happens to my home with Furness Building Society equity release?

Your home remains yours, but the lender will have a legal charge on it until the loan is repaid.